The bold move of demonetization by PM Narendra Modi is aimed to have multiple goals. Increasing digital transactions is considered as the most important goal among many other goals. To turn this into reality, the government has come up with a couple of schemes like Lucky Grahak Yojna and Digi-dhan Vyapar Yojna. These two schemes were just like any other start-ups Referral scheme. However, the government didn’t stop here they went a step ahead and launched BHIM app (Bharat Interface for Money) to enable fast, reliable, secure and easy to use cashless payments system through any smartphone. BHIM app is a tribute to Baba Saheb Ambedkar. The best part of this, it also works with a feature phone by entering the USSD *99#. The USSD has almost all the features of that of BHIM app.

Here’s how to set up a BHIM account:

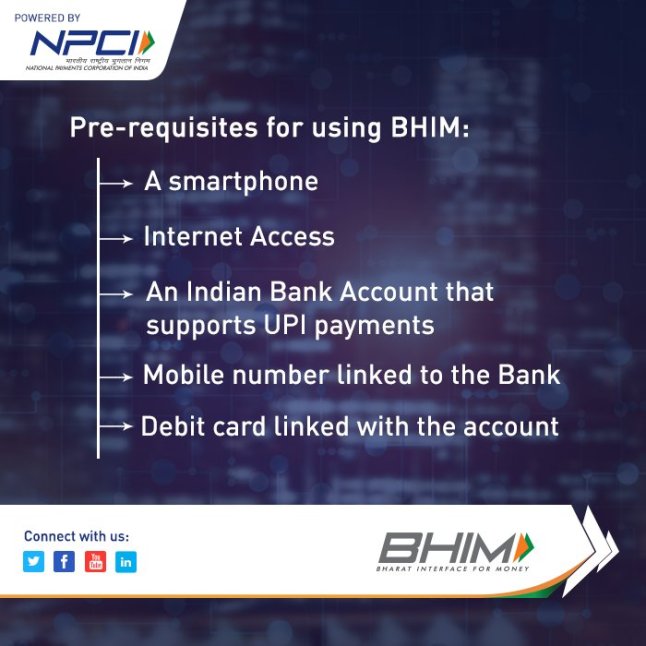

A user needs to have a smartphone, internet access along with UPI enabled bank account. The user should also have a valid debit card with his mobile number linked to the bank account. If you are ready with all this, then you are ready to go. During the registration, the app will send a message to verify your number. (usually, costs Rs.1.50). BHIM is available both on Android and iOS. One important thing to note at the time of registration is – the mobile number which is linked to the bank account should be present in the same phone as that of BHIM app because it will auto-verify the mobile number, unlike the OTP thing by other players. BHIM uses VPA (Virtual Payment Address) of the form xyz@upi or 9014949xxx@upi to send and receive money.

Why you need to use BHIM:

Why you need to use BHIM:

Ther are three reasons for this –

- BHIM is quite different from Payment wallets like PayTm or FreeCharge. Wallets deduct money from your bank account and credit them into their wallets before making a transaction. There is no mediator like a wallet in BHIM app, transactions take place directly from the bank accounts and refunds also will be credited into the bank accounts directly.

- No more waiting for an OTP before doing a successful transaction because BHIM uses predefined PIN to make transactions. It is the easiest way to transact and takes less than a minute for a successful transaction.

So, goodbye to those annoying 4-6 digit OTPs which will make us wait for a lifetime. - Third and the final reason is security. It has two step verification. First is the “passcode” to open the app and the next is “Pin” to make the payment. Presently, both passcode and pin can be same for some banks but this will change in near future.

My Experience:

I have been using this app since January 2017 and have easily transacted more than 50 times. It is very fast and also works on 2G networks. There were some issues with the payments to the merchant sometimes but the money deducted was refunded instantly. It is supported by wallets like PayTM and FreeCharge also. Presently, I am using this for every transaction that it supports. Out of excitement I even asked many of friends to try it out and guess what we pay money for each other with this app currently. The fact that money gets transferred instantly unlike NEFT & RTGS makes it unique from others. I request you people reading this to try it out and I’m sure you will love it. 🙂

Suggestions forwarded to the NPCI team:

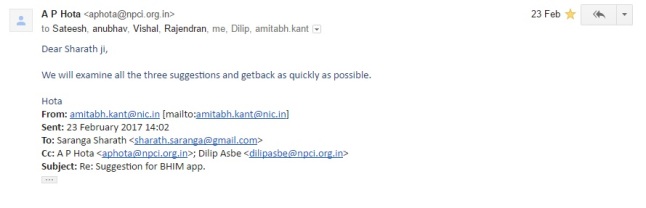

Even though the app is very good, it can have some improvements. I sent three of them to the NITI Aayog CEO Amitabh Kant who in turn forwarded the email to the team of BHIM. Following are the suggestions I have written to the development team of BHIM:

This was on 20th February, Kant ji was quick to respond and forward it to the team of NPCI.

CEO AP Hota replied positively to my query.

After 1 and half months of wait, BHIM has been updated to v1.3 with one my suggestion as the main update i.e. address book integration. COO of NPCI Dilip Abse has confirmed this on twitter this morning.

This gives me immense pleasure to share this with you. 🙂

PS: If at all you installed the BHIM app and wondering whom to send the money then I’m here for your rescue. Send the money to “ssc10@upi” and I will return the money by adding some extra bucks. 😀 😉

PPS: Each and every bank who has enrolled for UPI has a separate app. Out of all those apps, Flipkart’s PhonePe and Govt’s BHIM are my favorite. PhonePe has offers on its platform on regular basis. To be honest, me along with my friends have earned up to Rs. 2000 freely by using the PhonePe first transaction offer. 🙂

PPPS: Just now Narendra Modi has announced the referral scheme and cashback rewards for the BHIM app. Don’t be late, install it right away and test the app by sending money to ssc10@upi.

Suggestions welcome. 🙂